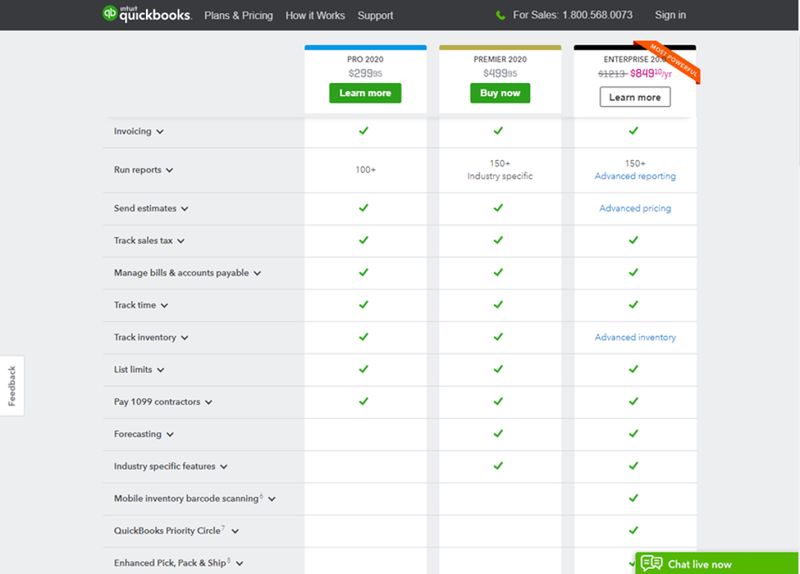

This ensures that every hour you pay your employees is considered for billing to a customer. The hours tracked then flow to both your customer invoices (if billable) and your payroll. QuickBooks can track your employee’s hours. QuickBooks has its own payroll function that can calculate and run payroll as often as you need it automatically. Mistakes made in calculating paychecks can result in steep penalties and unhappy employees. Payroll is an area that you don’t want to skimp on by trying to do it manually. Statement of Cash Flows in QuickBooks Online. Below is a sample Accounts Receivable (A/R) Aging Report from QuickBooks Online: You can view the amount of your outstanding invoices-known as your accounts receivable (A/R)-as well as how many days they are overdue by running an Accounts Receivable Aging Report. QuickBooks will automatically record the income and track how much each customer owes you. You can create invoices easily and either print them or email them to customers. Some business owners manage QuickBooks themselves while others prefer to use an in-house or outsourced bookkeeper. They also use it to generate month- and year-end financial reports as well as prepare for quarterly or annual business taxes. Small business owners typically use QuickBooks to manage their invoices, pay their bills, and track their cash flows.

Quickbooks for mac comparison for free#

You can try QuickBooks Online for free with a 30-day trial that does not require a credit card. QuickBooks offers several alternatives, but I recommend QuickBooks Online for most new businesses. The QuickBooks product line includes several solutions that work great for anyone, from a freelancer to midsized business. You can use it for invoicing customers, paying bills, generating reports, and preparing taxes. QuickBooks is the most popular small business accounting software businesses use to manage income and expenses and keep track of the financial health of their business.

0 kommentar(er)

0 kommentar(er)